Dairy Milk, the woes of Ugandan exporters

Uganda is a naturally gifted agricultural country. When you see the volumes of production under the largely subsistence approach that characterises our agriculture, the potential is immense. One sector whose potential has been proven is the Dairy Sector.

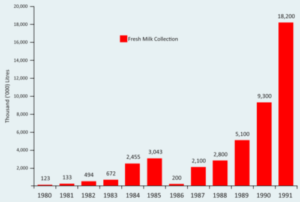

Milk production in the country experienced a nose dive in the 1970s all the way through the 80s. We relied alot on imports especially of milk products like powder milk, cheese among others. The Dairy Corporation used to collect and process 20 million litres of milk per annum in 1972 but this dropped to an all time low of less than half a million litres in 1983.

When the Government came up with the Diary Master Plan of 1993, it was a key turning point closely followed by the enactment of the Dairy Industry Act, 1998. As a result of these interventions, the industry monopoly enjoyed by the Dairy Corporation was removed, allowing other private players to venture into processing.

The Dairy market in Uganda is dominated by small scale dairy farmers who contribute 80% to the overall milk production in the nation followed by 20.0% from the large scale dairy farms. Their production is mainly based on low input traditional pasture production systems making the country one of the few low cost producers in the world.

Liberalisation of the sector has seen annual production grow from 9.3 million litres in 1990 to 2.5 Billion in 2019. Production growth is estimated at 18% per annum. This shows the high prospects the sector holds.

Some of the players include; Brookside Dairy, Jesa Farm Dairy, Pearl Dairy Farms, Amos Dairies and GBK Dairies. Due to local market limitations, they have ventured into the export market with Kenya being the leading destination. A move that seems to have disrupted the dairy industry in that country.

According to the Dairy Development Authority (DDA),exports stood at US $ 60 million in 2016 and increased to approximately USD 130 million in 2017/18, a figure expected to hit USD 500 million in a few years from now if trade conditions stabilise. The increase in the net exports has been as a result of increased compliance and meeting standards of Uganda’s milk and milk products on both regional and international markets due to efforts by DDA in regulation and quality assurance. Dairy exports mainly go to EAC, COMESA countries and SADC SADC, UAE, Nigeria, Syria, Egypt, Omen, USA, Nepal & Bangladesh. The exported dairy products include; UHT milk, ghee, casein, whey proteins, and butter oil among others

The East African community was founded to among others foster a large regional market for goods and services through free trade. However, over the years, trade conflicts have cropped up between some member states. In 2019, Kenyan Egg traders came out in arms over the cheap imported Ugandan eggs and wanted a ban placed on their importation but the government refused to cave in to the demand.

Following the assault of dairy products from Uganda on the Kenyan market, tensions begun simmering as the local dairy sector struggled. This culminated in the slapping of a 16% Value Added Tax on Milk imports from Uganda.

Rwanda had already stopped milk imports from Uganda heavily impacting some companies like Pearl Dairy Farms whose Lato Milk product was on demand.

Having nurtured the Dairy Sector from insignificance to the current successes it is enjoying, it would be foolhardy for the Government of Uganda to simply let it struggle through these challenging waters without intervening. Access to a large regional market is an attribute used to lure investors. With an annual production potential of 10 Billion litres of milk the sector is set for further growth. These non tariff barriers are likely to prevent further investment and kill budding businesses that could have used the EAC market to become significant global industry players.

The onus therefore is with the regional governments to come together and address this and other trade issues being affected by Non Tariff barriers.

James Wire

Small Business Consultant

The post Dairy Milk, the woes of Ugandan exporters appeared first on The Cooperator News.